Cryptocurrency has transformed the way we think about money, investments, and finance. Over the past decade, digital currencies like Bitcoin and Ethereum have captured the imagination of investors, tech enthusiasts, and the general public alike.

From the exhilarating highs of price surges to the nail-biting lows of market crashes, cryptocurrency investments have become a rollercoaster ride that many people want to be a part of.

But what exactly are cryptocurrencies? How do they work? And most importantly, how can you invest in them wisely? In this comprehensive guide, we’ll dive into the world of cryptocurrency investments, exploring their benefits, risks, and the strategies you can employ to navigate this ever-evolving landscape.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments (like the US dollar or the Euro), cryptocurrencies operate on a technology called blockchain—a decentralized network that records transactions across a multitude of computers.

This decentralization makes cryptocurrencies immune to control by a single entity, which is one of the core reasons they are considered revolutionary.

The most well-known cryptocurrency is Bitcoin, which was created in 2009 by an anonymous person (or group) known as Satoshi Nakamoto.

Since then, thousands of alternative cryptocurrencies, often referred to as “altcoins,” have emerged, each with its unique features, uses, and values. Some popular altcoins include Ethereum, Ripple (XRP), Litecoin, and Cardano.

How Does Cryptocurrency Work?

To understand cryptocurrency investments, it’s crucial to grasp how cryptocurrencies work on a fundamental level. Here’s a simplified breakdown:

- Blockchain Technology: The backbone of most cryptocurrencies, a blockchain is a public ledger that records all transactions made in a particular cryptocurrency. This ledger is distributed across a network of computers (nodes) and is continually updated. Each transaction is grouped into a block, which is then linked to the previous block, forming a chain—hence the name, blockchain.

- Decentralization: Unlike traditional currencies that are controlled by central banks or governments, cryptocurrencies are decentralized. This means that no single entity has control over the currency, making it theoretically immune to government interference or manipulation.

- Cryptography: Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units. This makes it extremely difficult to counterfeit or double-spend digital currencies.

- Mining: In the context of cryptocurrencies like Bitcoin, mining is the process by which new coins are created and transactions are verified. Miners use powerful computers to solve complex mathematical problems, and when a problem is solved, a new block is added to the blockchain, and the miner is rewarded with a certain amount of cryptocurrency.

Benefits of Cryptocurrency Investments

Now that we understand the basics of what cryptocurrencies are and how they work, let’s explore some of the potential benefits of investing in them:

1. High Potential Returns

One of the main reasons people are drawn to cryptocurrency investments is the potential for high returns. Bitcoin, for instance, was worth just a few cents when it was first introduced. Those who invested in Bitcoin early and held onto it saw astronomical returns as its value soared to tens of thousands of dollars per coin.

Similarly, other cryptocurrencies have experienced significant price increases over short periods, providing early investors with substantial profits. While not guaranteed, the possibility of high returns is a key attraction for many investors.

2. Diversification

Cryptocurrencies can provide diversification in an investment portfolio. Traditional assets like stocks, bonds, and real estate often correlate with economic conditions and geopolitical events. Cryptocurrencies, on the other hand, operate independently of these factors to some extent. Adding digital assets to your portfolio can help spread risk and reduce volatility, particularly when traditional markets are experiencing downturns.

3. Accessibility and Liquidity

Investing in cryptocurrencies is relatively easy compared to traditional assets. Anyone with an internet connection and a device can buy and sell cryptocurrencies through various online platforms and exchanges. This accessibility makes it possible for people from all over the world to participate in the cryptocurrency market.

Additionally, cryptocurrencies are known for their liquidity. The market operates 24/7, allowing investors to trade at any time. This constant trading means there’s usually a buyer or seller available, making it easy to enter or exit positions.

4. Protection Against Inflation

One of the selling points of cryptocurrencies, particularly Bitcoin, is their potential to serve as a hedge against inflation. Unlike fiat currencies, which can be printed in unlimited quantities by central banks, many cryptocurrencies have a capped supply. For example, the total supply of Bitcoin is limited to 21 million coins. This scarcity can help preserve value over time, especially in environments where traditional currencies are losing purchasing power due to inflation.

5. Innovation and Adoption

Investing in cryptocurrencies also means investing in innovation. Blockchain technology, the foundation of cryptocurrencies, has the potential to revolutionize various industries by providing more secure, transparent, and efficient ways to conduct transactions. As more businesses and institutions adopt cryptocurrencies and blockchain technology, the demand for digital assets may increase, potentially driving their value higher.

Risks of Cryptocurrency Investments

While the benefits are enticing, it’s essential to recognize the risks involved in cryptocurrency investments. Like any investment, cryptocurrencies come with their own set of challenges that investors must navigate carefully.

1. Volatility

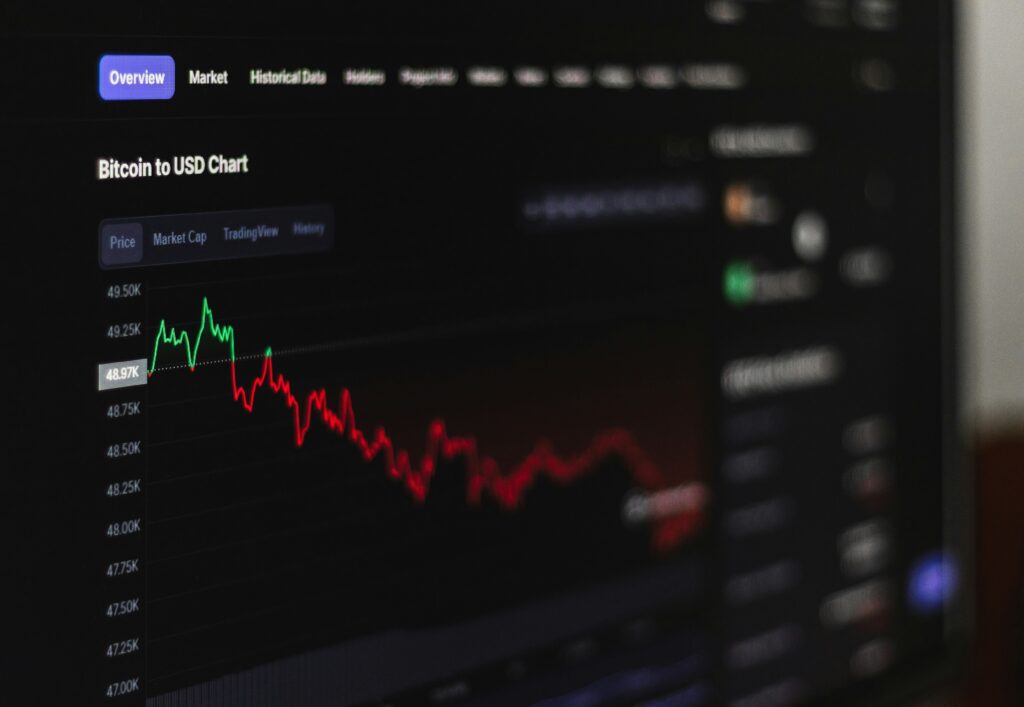

Cryptocurrency markets are known for their volatility. Prices can experience significant fluctuations within short periods, sometimes within hours. For example, Bitcoin has experienced price drops of over 50% in just a few months. This volatility can lead to substantial gains, but it can also result in significant losses, making cryptocurrencies a high-risk investment.

2. Lack of Regulation

The cryptocurrency market is still relatively new and largely unregulated compared to traditional financial markets. This lack of regulation can lead to issues such as market manipulation, fraud, and scams. While efforts are being made to establish clearer regulatory frameworks, the current landscape remains uncertain, which can pose risks to investors.

3. Security Concerns

Despite the use of cryptography, cryptocurrencies are not immune to security breaches. Hacking incidents and cyberattacks on exchanges and wallets have led to the loss of millions of dollars’ worth of digital assets. While security measures have improved, the decentralized nature of cryptocurrencies means that if your funds are stolen, recovery can be challenging.

4. Limited Acceptance

While the adoption of cryptocurrencies is growing, they are still not universally accepted as a form of payment. Many businesses and institutions do not accept cryptocurrencies, limiting their practical use. This limited acceptance can impact the demand and, consequently, the value of digital currencies.

5. Technological Risks

Cryptocurrencies rely on blockchain technology and digital infrastructure. Technological failures, bugs, or vulnerabilities can pose risks to the stability and security of digital assets. Additionally, as technology evolves, newer and more advanced cryptocurrencies may emerge, potentially rendering older ones obsolete.

How to Invest in Cryptocurrencies Wisely

Understanding the benefits and risks is crucial for anyone considering investing in cryptocurrencies. Here are some strategies and tips to help you invest wisely in this dynamic market:

1. Do Your Research

Before investing in any cryptocurrency, conduct thorough research. Understand the underlying technology, the purpose of the cryptocurrency, its market potential, and the team behind it. Look into whitepapers, project roadmaps, and community support. Staying informed will help you make educated decisions and avoid falling victim to hype or misinformation.

2. Start Small and Diversify

Given the volatility and risk involved, it’s wise to start with a small investment that you can afford to lose. As you become more comfortable and knowledgeable, you can consider increasing your investment. Diversification is also key. Don’t put all your funds into one cryptocurrency. Spread your investment across multiple digital assets to minimize risk.

3. Use Reputable Exchanges and Wallets

Choose well-established and reputable cryptocurrency exchanges for buying and trading digital assets. Research the security measures and user reviews of the platforms you plan to use. Additionally, store your cryptocurrencies in secure wallets. Hardware wallets, which are offline devices, offer an extra layer of security against hacking and theft.

4. Stay Informed About Market Trends

The cryptocurrency market is influenced by various factors, including regulatory news, technological advancements, and macroeconomic events. Stay informed about market trends and news that could impact the value of your investments. Set up alerts, follow reliable cryptocurrency news sources, and join online communities to stay updated.

5. Be Prepared for Volatility

Understand that price volatility is a natural part of the cryptocurrency market. Don’t panic during market downturns, and avoid making impulsive decisions based on short-term price movements. Have a clear investment strategy and stick to it, whether it’s a long-term hold, dollar-cost averaging, or a different approach.

6. Understand Tax Implications

Cryptocurrency investments can have tax implications, depending on your country of residence. In many places, cryptocurrencies are treated as taxable assets, and gains or losses must be reported to tax authorities. Be aware of the tax regulations in your jurisdiction and keep accurate records of your transactions.

Real-World Examples: Navigating Cryptocurrency Investments

To provide a clearer understanding of cryptocurrency investments, let’s look at a few real-world examples:

Example 1: The Bitcoin Boom and Bust

In 2017, Bitcoin experienced a massive surge, reaching an all-time high of nearly $20,000 per coin in December. Many investors, caught up in the excitement, bought Bitcoin at its peak, hoping for continued gains. However, by early 2018, Bitcoin’s price had plummeted by more than 50%, leading to significant losses for those who bought at the top.

This example highlights the importance of understanding market cycles and being cautious during periods of hype and rapid price increases. Experienced investors who had researched Bitcoin’s fundamentals and market trends may have anticipated the correction and adjusted their strategies accordingly.

Example 2: The Rise of Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, has become one of the most significant trends in the cryptocurrency space. DeFi platforms offer traditional financial services, such as lending and borrowing, but operate on blockchain networks without intermediaries. The rise of DeFi has led to the creation of numerous cryptocurrencies and tokens associated with DeFi projects.

Investors who recognized the potential of DeFi early on and invested in DeFi-related cryptocurrencies saw substantial returns as the sector gained popularity. This example demonstrates the value of staying informed about emerging trends and being willing to explore new investment opportunities within the cryptocurrency market.

Example 3: The Security Breach at Mt. Gox

Mt. Gox was once the largest Bitcoin exchange, handling around 70% of all Bitcoin transactions. In 2014, the exchange suffered a major security breach, leading to the loss of approximately 850,000 Bitcoins. The incident caused a significant drop in Bitcoin’s price and led to the bankruptcy of Mt. Gox.

This example underscores the importance of security in cryptocurrency investments. Investors who kept their Bitcoins on the exchange lost their funds, while those who stored their assets in secure wallets were unaffected. It’s a reminder to prioritize security measures and choose trustworthy platforms and storage solutions.

How Our Team Came Up with These Insights

In crafting these insights, our team drew upon a blend of personal experiences, client interactions, and extensive research. We closely followed the cryptocurrency market trends, analyzed past performance data, and studied emerging technologies to understand the evolving landscape of digital assets.

Our team has witnessed the highs and lows of the market, helping clients navigate the complexities of cryptocurrency investments.

By leveraging our expertise and firsthand experiences, we aim to provide valuable, practical advice that empowers investors to make informed decisions and thrive in the world of cryptocurrency.

Conclusion

Cryptocurrency investments offer exciting opportunities for high returns, diversification, and innovation. However, they also come with significant risks, including volatility, security concerns, and regulatory uncertainties.

By understanding how cryptocurrencies work, recognizing the benefits and risks, and employing smart investment strategies, you can navigate the world of digital assets with greater confidence.

Remember, successful investing in cryptocurrencies requires continuous learning, adaptability, and a level-headed approach. Whether you’re a seasoned investor or a newcomer, staying informed, managing risks, and making decisions based on thorough research will help you harness the potential of cryptocurrencies while safeguarding your financial future.

Leave a Reply